Considering the ‘what ifs’ is critical in commercial loan underwriting. What if property vacancies increase? What if interest rates rise (which they will)? What if property values drop?

Performing stress testing as part of the underwriting and periodic review process can help your credit union understand the potential impact of unplanned events such as declines in collateral values, strains on liquidity, and more, and aid you in mitigating current and potential risk.

So what should you stress test for? Here’s a list of the key factors your credit union should be stress testing for regularly:

- Changes in collateral value (cap rate or actual value) – for loans secured by CRE

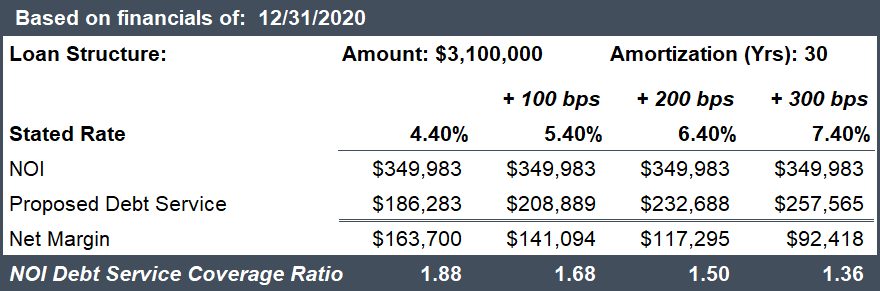

- Changes in interest rates on adjustable rate and variable rate loans – Evaluate how much the interest rate can increase before the borrower reaches a policy minimum or breakeven DSCR. Showing DSCRs at increasing interest rates helps show possible cash flow issues in the future, should rates rise. Many loans made in 2018 are set have rate resets in 2023, will these new higher rates impact cash flow? Here’s an example:

NOI Rate Sensitivity Test:

- Changes in vacancy or occupancy (investment property loans) – Test how much vacancy an investment property can experience before reaching or falling below the policy minimum DSCR or breakeven.

- Changes in rental income (single-family investment property loans) – Evaluate the minimum rental income required to reach the policy minimum DSCR or breakeven.

- Changes in business sales/revenues or expenses – Test how much revenue decline or expense increase can be sustained before the loan DSCR falls below policy minimum and what changes would bring the loan to breakeven. This is especially important as inflation impacts business operating costs.

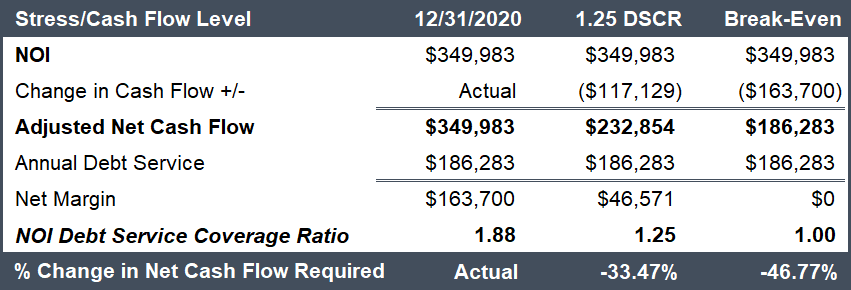

- Changes in cash flow – Determine what DSCR looks like with reductions in net operating income. Here’s an example:

Property Cash Flow Stress Test:

- Lines of credit – Stress test DSCR based on monthly principal and interest payments, assuming both a fully funded, and even a termed-out line.

Want to learn more? Check out CUBG’s webinar on Stress Testing for Better Loans and a Healthier Portfolio, available on-demand.